China’s Mini Truck Market Posts Strong November Growth

December 30,2025

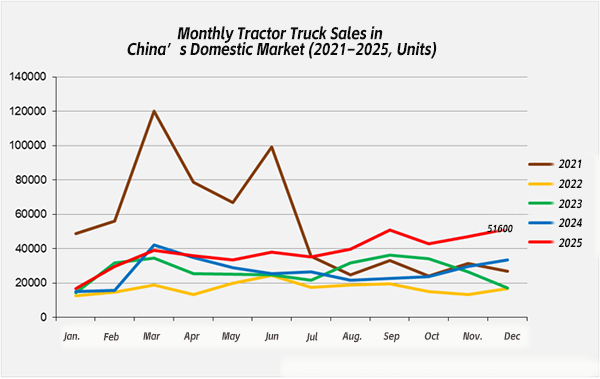

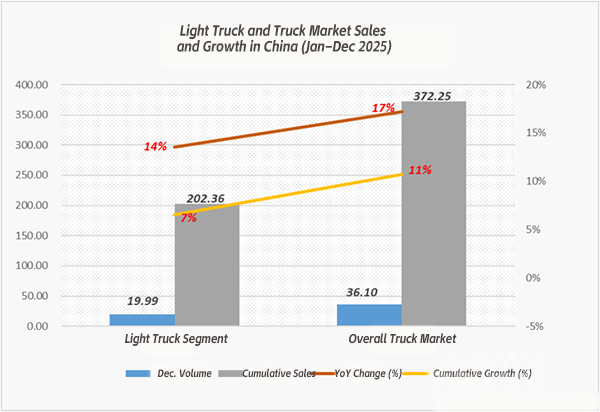

Data from the China Association of Automobile Manufacturers (CAAM), based on manufacturer invoice figures rather than retail sales, showed that total truck sales in China reached 338,400 units in November, up 9% from October and 26% from a year earlier. Mini truck sales accounted for 36,100 units, representing an 18% month-on-month increase and the fifth consecutive month of year-on-year growth.

The mini truck segment’s 48% annual growth rate in November was well above the overall truck market’s 26% increase, allowing the segment to continue outperforming the wider industry.

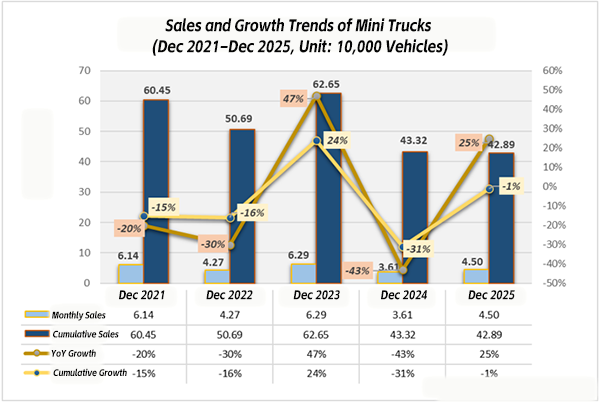

Despite the strong November performance, the mini truck market has remained volatile throughout 2025. From January to October, sales rose for two months, declined for four months, and then rebounded for another four months. By the end of October, cumulative sales were still down 7% compared with the same period last year.

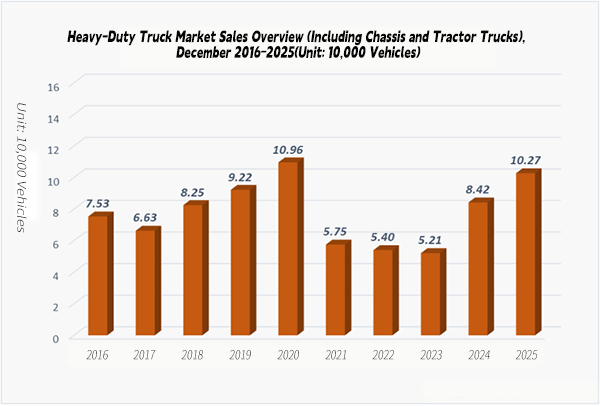

Looking at longer-term trends, November sales over the past five years have followed an alternating pattern of growth and decline. Although November 2025 marked one of three years in that period to post year-on-year growth, the sales volume ranked second lowest among the past five Novembers, highlighting that the market remains at a relatively low base.

Sales in November were about 34,000 units lower than the peak recorded in November 2021, amounting to just over half of that level. However, volumes were around 12,000 units higher than in November 2024.

From January to November 2025, cumulative mini truck sales totaled 383,900 units, the weakest performance for the period in the past five years. The total was approximately 13,000 units lower than a year earlier and nearly 180,000 units below the peak recorded in the first eleven months of 2023.

Market concentration remained high in November. Only three manufacturers held more than 10% market share. Wuling retained a dominant position, selling 20,100 units and accounting for 55.63% of total mini truck sales. Changan and Chery ranked second and third, with sales of 7,323 units and 3,930 units, corresponding to market shares of 20.31% and 10.90%, respectively.

Shandong Kama, Dongfeng and Geely Farizon followed in fourth to sixth place, each with market shares below 5%. Together, the top six manufacturers accounted for 99.59% of total mini truck sales in November.

Nine companies reported mini truck sales during the month, one more than in October. Linghe Automobile entered the segment for the first time, selling 10 units. Compared with November 2024, six manufacturers recorded year-on-year growth, while three saw declines. Wuling, Changan and Foton posted growth rates of 97%, 236% and 63%, respectively, outperforming the segment average. Two manufacturers experienced double-digit declines, with the steepest fall reaching 52%.

For the January–November period, cumulative mini truck sales declined 3% year on year, an improvement from the 7% decline recorded by the end of October. Eleven manufacturers reported cumulative sales during the period, with seven posting growth and four reporting declines. Chery and Yuchai New Energy recorded the fastest cumulative growth, while several smaller players continued to see steep drops, including one manufacturer whose sales fell by 95%.

In terms of cumulative market share, Wuling, Changan and Chery together controlled more than 80% of the market in the first eleven months of 2025. Other manufacturers held single-digit shares, while most accounted for less than 0.5%.

Overall, the mini truck market saw two months of growth early in the year, followed by four months of decline and a five-month rebound from July to November. With only one month remaining in 2025, it remains uncertain whether the segment can end the year with a return to full-year growth.

Views : 5246