China Tractor Truck Sales Up 54% in Dec., 2025 Full-Year Sales 460,000 Units

January 31,2026

For the full year, total tractor truck sales reached 458,700 units, up 43% from 2025. This represents an increase of nearly 140,000 units compared with the previous year.

December Sales Reach 51,600 Units, Up Both Month on Month and Year on Year

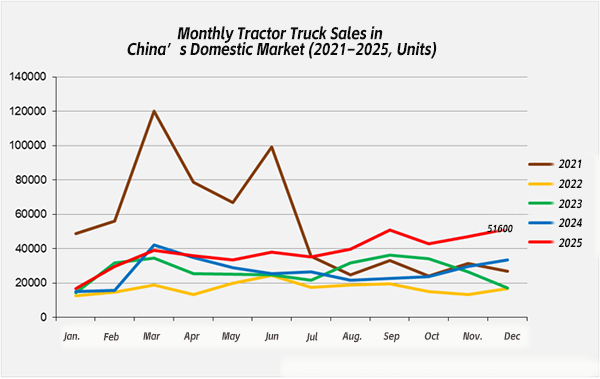

In December 2025, China’s tractor truck terminal sales totaled 51,600 units, based on compulsory insurance registration data and excluding exports and military vehicles.

Sales increased 10% compared with November and rose 54% year on year. Although the growth rate was slightly lower than November’s 58%, December sales were still about 18,100 units higher than in December 2024.

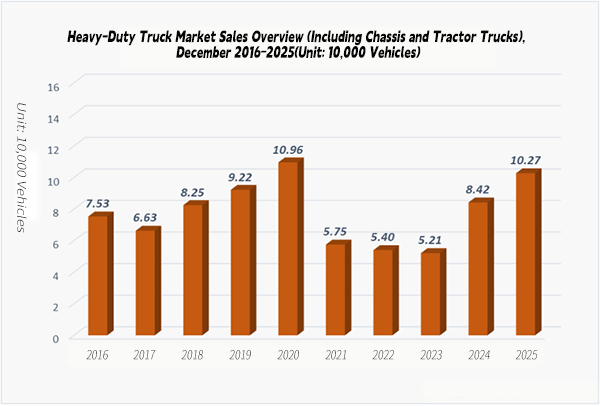

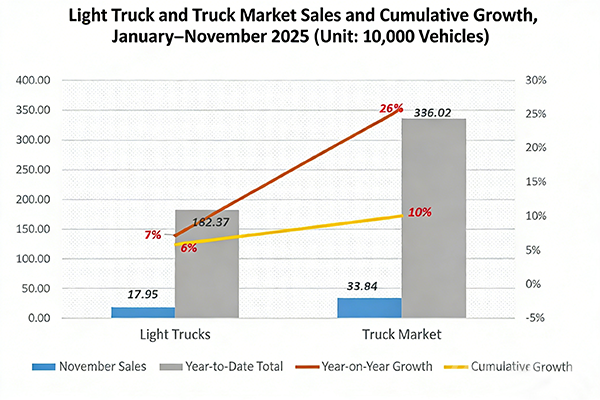

During the same month, overall heavy-duty truck terminal sales grew 21% year on year. Tractor trucks outperformed the broader heavy truck market by 33 percentage points and have now exceeded the market average for five consecutive months.

In December, tractor trucks accounted for 61.44% of total heavy truck terminal sales, slightly higher than in November. For the full year, tractor trucks made up 57.33% of the heavy truck market, up 4.23 percentage points from 2024.

From a historical perspective, average December tractor truck sales between 2021 and 2024 were only about 23,500 units. The 51,600 units sold in December 2025 marked the highest December level in nearly five years.

FAW TRUCKS and Sinotruk Lead, XCMG and SANY Close in on Top Five

In December 2025, FAW TRUCKS ranked first with sales of 8,831 units, followed by Sinotruk with 8,129 units.

SHACMAN, Dongfeng, and Foton ranked third to fifth, with sales of 6,259 units, 5,597 units, and 5,119 units, respectively.

XCMG and SANY recorded sales of 4,576 units and 4,026 units, ranking sixth and seventh and narrowing the gap with the industry’s top five players.

Against the backdrop of overall market growth, most major tractor truck manufacturers achieved positive year-on-year growth in December.

Several Brands Post Triple-Digit Growth, Market Remains Highly Concentrated

In December, several manufacturers reported triple-digit growth rates.

Geely Remote, United Trucks, and Yutong recorded year-on-year increases of 217%, 813%, and 495%, respectively, significantly outperforming the overall market.

Sinotruk, XCMG, and SANY also exceeded the market average, with growth rates of 62%, 81%, and 83%.

Shaanxi Auto, Dongfeng, and Foton achieved double-digit growth, though below the overall market pace. Shandong Leichi recorded net growth.

The top ten tractor truck manufacturers accounted for 91.4% of total market sales in December. FAW TRUCKS led with a 17.1% market share, followed by Sinotruk at 15.8%, Shaanxi Auto at 12.1%, and Dongfeng at 10.8%.

Foton ranked fifth with a 9.9% share. The combined share of the top five players was 65.8%, slightly lower than the previous month.

Compared with November, there were changes in both rankings and participants. United Trucks re-entered the top ten, ranking ninth. Shaanxi Auto and Dongfeng each moved up one position. Rankings for FAW TRUCKS, Sinotruk, XCMG, SANY, and Geely Remote remained unchanged.

Full-Year Sales Rise 43%, New Energy Share Expands Rapidly

In 2025, total tractor truck terminal sales reached 458,700 units, up 43% year on year, one percentage point higher than the growth rate recorded through November.

All top ten manufacturers achieved year-on-year growth for the full year. XCMG and SANY posted the fastest growth, up 172% and 146%, respectively. Foton, Shaanxi Auto, and Geely Remote also outperformed the market average.

FAW TRUCKS, Sinotruk, Dongfeng, BAIC, and JAC recorded double-digit growth, though below the industry average.

The combined market share of the top ten manufacturers reached 95.5% in 2025. FAW TRUCKS ranked first with a 22.9% share, followed by Sinotruk at 18.1%, Foton at 13.0%, Dongfeng at 12.8%, and Shaanxi Auto at 12.6%. Compared with 2024, five manufacturers increased their market share, with XCMG, SANY, and Foton seeing the largest gains.

Energy Mix Shifts as New Energy Tractor Trucks Surge

Alongside intensifying competition, the fuel mix of the tractor truck market continued to change.

In 2024, natural gas tractor trucks held the largest market share. In 2025, their share fell by more than 12 percentage points. Diesel tractor truck share also declined by 8.09 percentage points.

In contrast, pure electric tractor trucks saw their market share rise by 21 percentage points compared with 2024. Shares for hybrid, methanol, and fuel cell tractor trucks remained broadly stable.

In terms of sales performance, diesel tractor truck sales grew only 1% in 2025, with a sharp 61% year-on-year decline in December. Natural gas tractor truck sales rose 11% for the year and 31% in December. Methanol tractor truck sales fell 64% year on year.

New energy tractor truck sales surged 216% in 2025. Pure electric models rose 228%, while fuel cell and hybrid tractor trucks increased by 36% and 213%, respectively.

New energy tractor trucks accounted for 17.43% of total sales in 2024. In 2025, this figure climbed to 38.47% and continued to rise month by month. In December alone, new energy models represented 67.2% of tractor truck sales.

All of the top 12 tractor truck manufacturers sold new energy models in 2025. Among the top five players, the share of new energy vehicles exceeded 20%. XCMG, SANY, and Geely Remote recorded the highest proportions, with new energy models accounting for 98.69%, 99.58%, and 91.15% of their tractor truck sales, respectively.

Since April 2025, China’s tractor truck market has achieved nine consecutive months of year-on-year growth, with full-year sales up 43% and net growth of nearly 140,000 units.

New energy tractor trucks remained the main growth driver throughout the year, with their share exceeding 60% in December. Although the share of natural gas tractor trucks declined, they remain an important part of the market.

Whether the market structure and competitive landscape will change further in 2026 remains to be seen.

Views : 3931